Tesla Dives as Annual Deliveries Hit a Wall for the First Time

Introduction

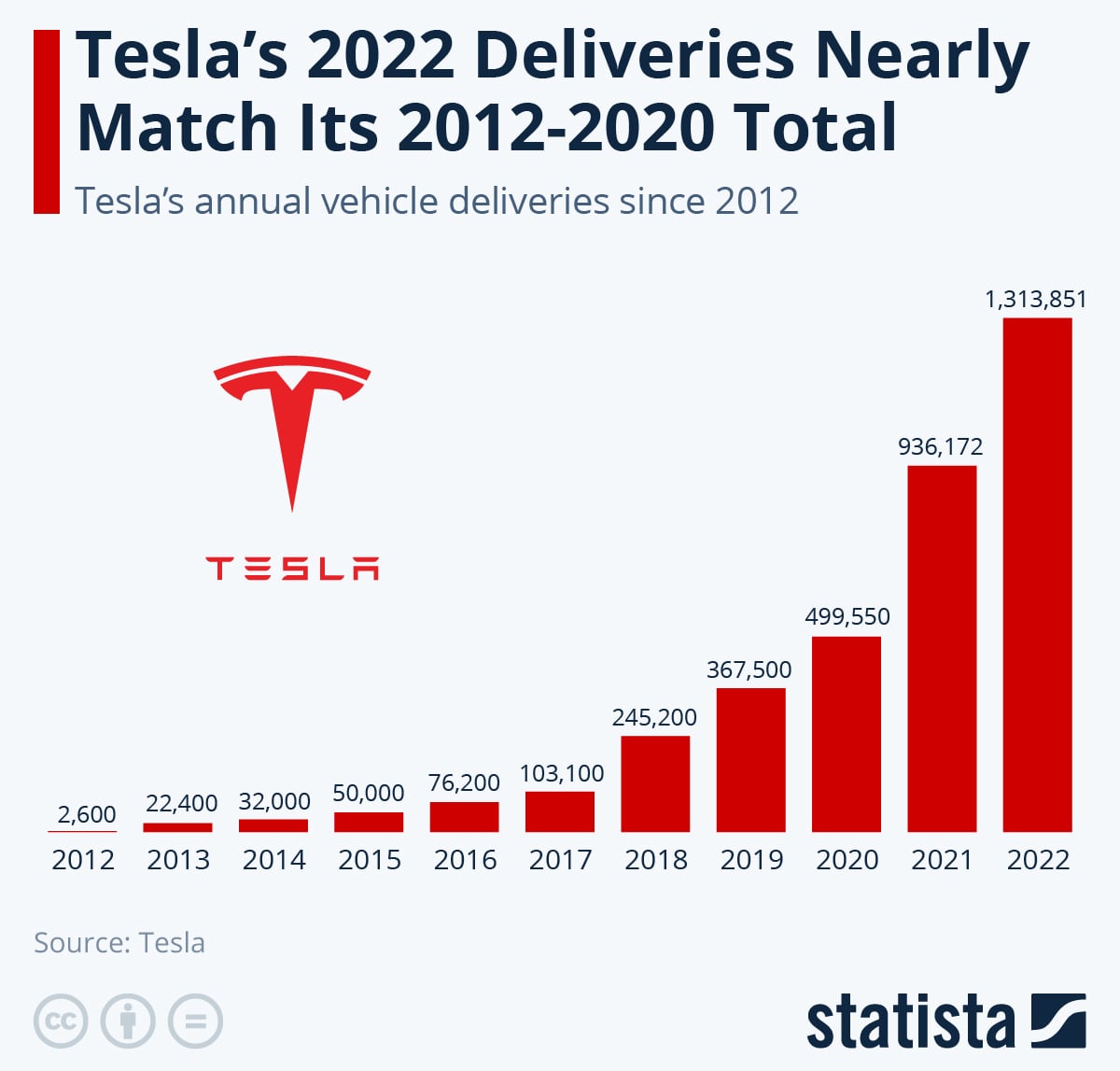

Tesla, the electric vehicle (EV) pioneer, recently faced a significant setback as its annual deliveries fell short of expectations for the first time. This news has sent shockwaves through the automotive industry and has raised questions about the company’s future prospects. In this critical analysis, we examine the complexities surrounding Tesla’s decline and provide a comprehensive understanding of the various perspectives and implications.

Reasons for the Decline

Tesla’s delivery shortfall can be attributed to a combination of factors:

- Production Constraints: The company has encountered supply chain disruptions, chip shortages, and labor challenges, which have hindered production output.

- Increased Competition: The EV market is becoming increasingly competitive, with legacy automakers and startups offering new and improved models. Tesla now faces stiffer competition in all segments.

- Macroeconomic headwinds: Rising interest rates and inflation have dampened consumer spending, potentially affecting Tesla’s premium vehicle prices.

- Pricing Strategy: Critics argue that Tesla’s consistent price increases may have made its vehicles less affordable for some consumers.

Market Reaction

Tesla’s stock price has plummeted over 65% in the past year, reflecting investor concerns about the company’s growth prospects. Wall Street analysts have downgraded their Tesla ratings and lowered their target prices. The market’s negative reaction indicates a loss of confidence in the company’s ability to maintain its dominance in the EV market.

Perspectives

There are varying perspectives on Tesla’s recent decline:

- Bearish Outlook: Some analysts believe that Tesla’s best days are behind it and that its stock is overvalued. They cite increasing competition, production challenges, and a potential demand slowdown as reasons for their pessimism.

- Optimistic Outlook: Others remain bullish on Tesla, arguing that it is still the leader in EV technology and has a strong brand. They believe that Tesla will overcome its current challenges and continue to grow in the long term.

Analyst Opinions

Industry analysts have provided their expert opinions on Tesla’s situation:

- “Tesla’s delivery miss is a wake-up call for investors. The company faces significant challenges, and its growth story may be coming to an end.” – Dan Ives, Wedbush Securities

- “While Tesla is facing headwinds, we believe in its long-term potential. The company has a strong pipeline of new products and is well-positioned to benefit from the global transition to EVs.” – Adam Jonas, Morgan Stanley

Conclusion

Tesla’s recent delivery shortfall has exposed challenges that have weighed on the company’s stock price. The reasons for the decline are multifaceted, ranging from production constraints to increased competition. While there are differing perspectives on Tesla’s future, it is clear that the company faces an uphill battle to regain investors’ confidence and maintain its dominance in the EV market. It remains to be seen whether Tesla can overcome its current obstacles and return to growth, or if its best days are truly behind it.

Reflection on Broader Implications

Tesla’s decline has broader implications for the EV industry and the automotive sector as a whole. It highlights the challenges faced by companies that are heavily reliant on innovation and technology. The case of Tesla also serves as a reminder that even the most successful companies can encounter setbacks and that investors should exercise caution when making investment decisions.