Decoding the Second-Quarter Earnings: A Glimpse into the Future

The second quarter earnings reports are in, and the utility sector is proving its mettle. Against a backdrop of economic uncertainty, these companies are not just surviving; they are thriving. The secret? Strategic investments and a focus on providing essential services. These companies are setting the stage for even greater success in the years to come. One standout performer that captures the attention of financial analysts is Atmos Energy Corp. (ATO). The energy sector is experiencing growth not seen since the 1950s. This is great news for investors looking for stability and growth potential in their portfolios. The current market conditions are ripe for these types of companies to thrive.

The Utility Sector: The Unsung Hero of the AI Revolution

The rise of Artificial Intelligence (AI) is reshaping industries, and the utility sector is quietly playing a pivotal role. These companies are the “picks and shovels” of the AI gold rush, providing the essential infrastructure that powers this technological revolution. While there may be some questions surrounding projections for future electricity demand, current company results and forward guidance clearly demonstrate that the growth is accelerating at a pace not seen in decades. These companies are experiencing some of their fastest growth in recent history. Investors are taking notice and this trend is expected to continue. The utility sector is becoming a cornerstone of a modern economy.

Navigating Risks and Capitalizing on Opportunities

Investing in the utility sector involves navigating a unique set of challenges and opportunities. The lowest-risk investments are generally found in regulated power and natural gas grids. One significant advantage is that capital expenditures (Capex) are often pre-approved by regulators, ensuring investment recovery through rate riders. This is a stark contrast to the past, where utilities faced uncertainty in cost recovery. While building major infrastructure projects can take years, most grid projects are completed within months. This allows companies to maintain tight control over costs, leading to predictable earnings growth. However, finding a good entry point can be tricky. Investors must look at the long term to ensure they select the right companies. This approach gives them a great opportunity to see their investments increase in value.

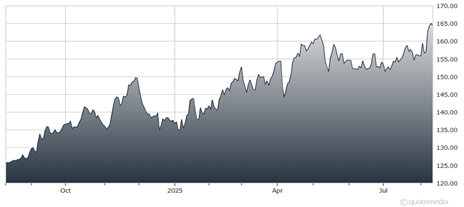

Atmos Energy Corp. (ATO): A Shining Example of Excellence

Atmos Energy Corp. (ATO) stands out as a prime example of success in the utility sector. The company has raised its FY2025 earnings guidance for the third time this year, demonstrating strong financial performance and confidence in its growth prospects. While the current yield may seem modest at just under 2%, the company’s robust earnings potential and strategic investments make it an attractive option for long-term investors. Atmos Energy is proof of how the utility sector can produce great results. The company is a good pick for those who want to stay on top of their finances. The continued positive performance makes them a reliable option in the sector.

The Takeaway: Why the Utility Sector is Worth Watching

In conclusion, the utility sector offers a compelling investment opportunity. With its essential services, regulatory advantages, and the tailwinds of the AI revolution, companies like Atmos Energy Corp. (ATO) are poised for continued growth. While challenges exist, the sector’s stability, predictability, and potential for earnings growth make it a valuable addition to any well-diversified portfolio. Keep a close eye on this sector, as it continues to evolve and adapt to the changing needs of our modern world. The utility sector is looking like a winner for the future and will only continue to grow.